If you’re looking at homes selling for more than $500,000, you need to know this.

Simply put, as of Monday February 15th, you now have to put down a payment of at least 10% on the portion of the price of a home over $500,000. The first $500,000 is still just 5%, but anything above that jumps to 10% And homes costing more than $1 million still require a 20% down payment.

That’s the Coles Notes version of the new mortgage rules for Canadians, designed to reduce housing risk.

This could be a big deal for a lot of homebuyers, as the down payment they need to save may have just jumped in a big way, with the old rate being 5%. For example, if you’re looking at a $700,000 home, the down payment will jump from $35,000 to $45,000.

That could be a deal breaker for first-time buyers.

Why the New Mortgage Rules?

It’s in the country’s best interest for Canadians to buy homes that they can actually afford. These new rules are in place to help ensure that happens, particularly in high price markets like Toronto and Vancouver.

“We recognize that, specifically in the Toronto and Vancouver markets, we have seen house prices that have been elevated,” Finance Minister Bill Morneautold reporters in December .

“And we want to make sure we create an environment that protects the people buying homes so they have sufficient equity in their home.”

How Does This Change Things?

The biggest pinch will clearly be felt by first-time homebuyers who need to now put up a larger down payment.

They may have to find an additional $8000-10,000 to put down, if they’ve been saving with the 5% number in mind. This could mean they now have to keep their home price budget to under $500,000, or find a way to come up with the extra money for a bigger down payment.

First-Time Buyers Should Look Outside Toronto

If you’re a first-time homebuyer, the new rules may mean you’re first home won’t be in Toronto, with almost nothing in the city for under $500,000.

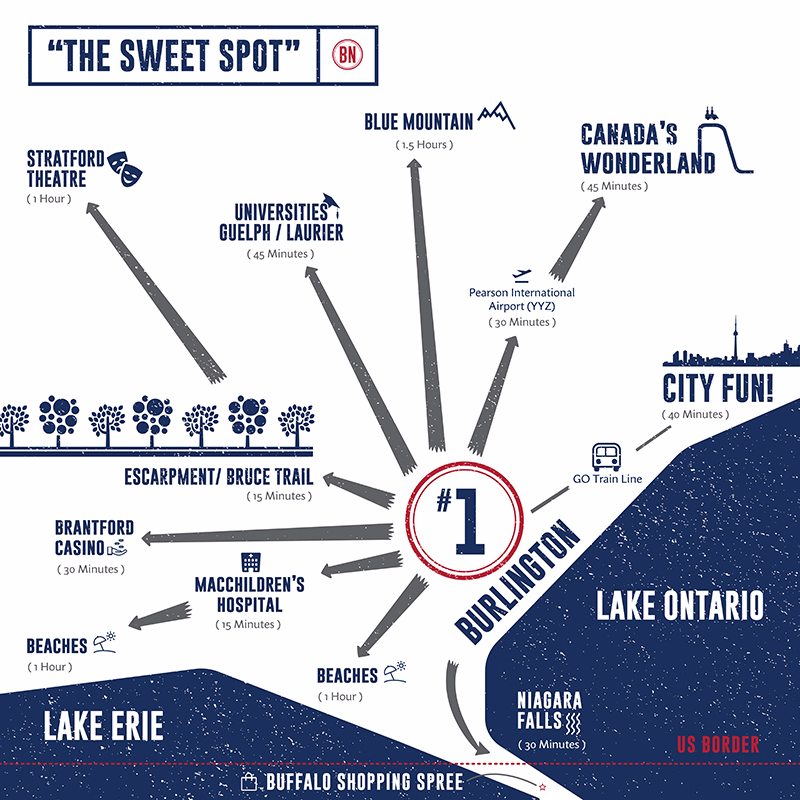

Come see what Burlington has to offer. We were recently named Canada’s best mid-sized city by MoneySense Magazine for the third straight year!

Start by browsing homes for sale in Burlington, or click here to contact us to ask us anything.